Free article - Macro takes: How the Euro destroyed Europe

My article this week will be of a special kind. It is a dossier rather than an article and it will focus on a macro topic that has been in the news lately rather than a deep dive on a specific listed or private company.

The topic: How the Euro destroyed Europe

Legend:

Above chart:

In red: Italian industrial production starting Jan 1st 2000 (basis 100)

In blue: German industrial production starting Jan 1st 2000 (basis 100)

Bottom chart:

In red: Italian industrial production starting Jan 1st 2000 (basis 100) (same as above)

In black: exchange rate between the Italian Lira and the Deutsch Mark

Gray surfaces: recessions

The thesis is simple: from 1970 to 2000, the growth of industrial production in Italy and Germany was roughly the same, with a slight advantage for Italy. Since January 2000 and the official start of the Euro, industrial production has collapsed in Italy, falling by 15% in 22 years, while German industrial production has continued on its initial trajectory and is now at just under 120. The thesis here is that the exchange rate lock between Germany and Italy in 2000 (the black line at the bottom of the chart that became horizontal) is the cause of the Italian (and French, and Spanish) collapse....... Previously, when Italy became uncompetitive with a more productive Germany, (which led to a recession in Italy, grey shading on the graph), the lira devalued against the Deutsch Mark (DM) (black line, right scale, bottom graph) and in doing so protected the profitability of Italian companies. This is no longer possible since 2000, the adjustment variable becomes the profitability of Italian companies and no longer the exchange rate Lira / DM, so they can not invest and growth collapses.

While many solid analysts and macroeconomists pointed to this issue as early as 2003 (namely Charles Gave, among others), The euro zone crisis happened only nine years later proving that paying the consequences of macroeconomic policy mistakes takes time to surface (For communism in Russia, it took more than 70 years before the system collapsed)

Euro turbulence in 2012

But how did the markets react to the disaster that was becoming obvious by 2012? Investors anticipated that the Euro was not going to survive and sold Italian bonds and bought German bonds, which made the spread between Germany and Italy explode as shown in the following graph.

Legend:

In gray: spot spread between german and italian 10yr bond yields

In yellow: 1-year rolling average spread between german and italian 10 yr bond yields

Gray surfaces: recessions

In the summer of 2012, Italian rates are close to 7%, German rates are at 2%, the rate spread is 5%, and the situation is unsustainable for Italy, which is entering a monstrous "debt trap", with its GDP growing at best 2% per year and its debt, at more than 100% of GDP, growing at 7% per year.

It is undeniable that the Euro has de-industrialized all countries of southern Europe (Italy in this example, as well as, Spain, Greece among others).

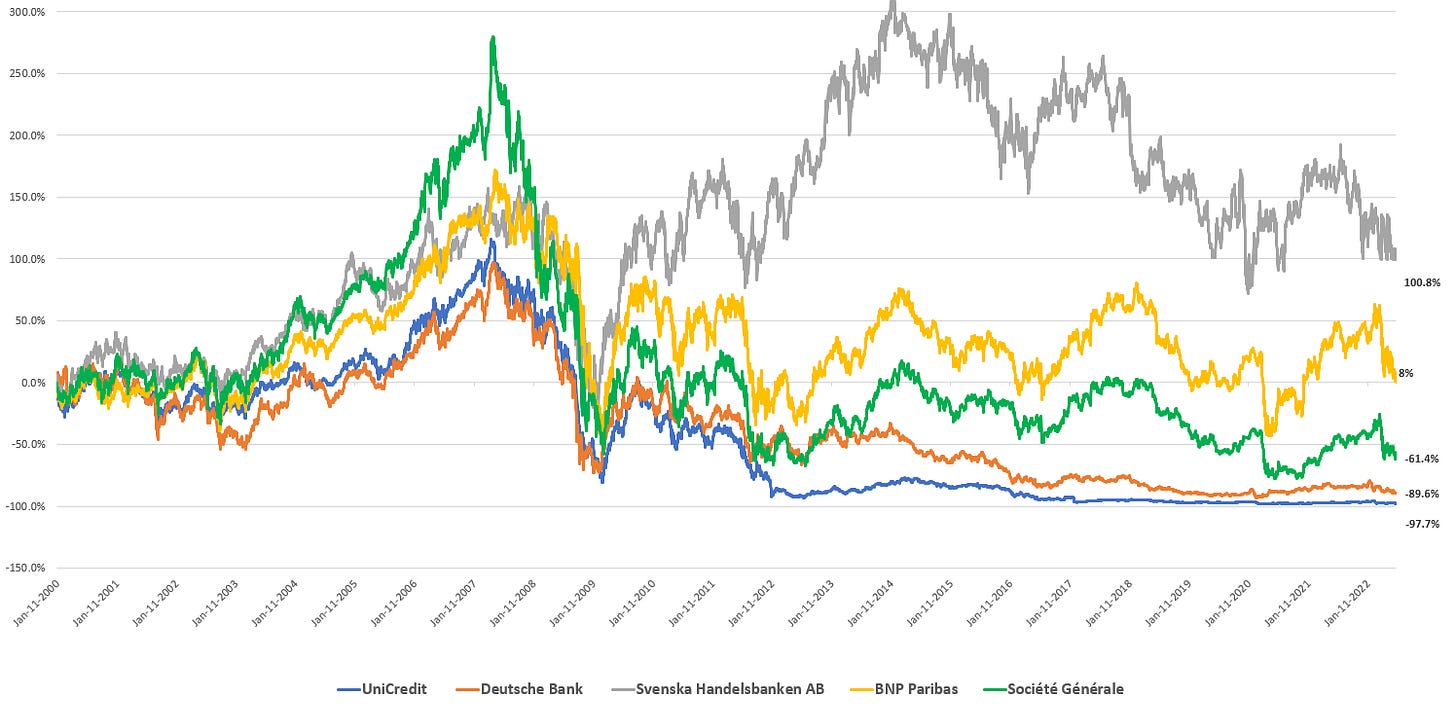

The quasi-bankruptcy of the European banking system

The banks all over the world, from 2007 to 2009, had to take big losses because of the GFC, reaching lows around March 2009.

From 2009 to 2011 the stock prices of all banks rose, but from 2012 onward, the crisis of the euro zone made the european banks' prices fall again and since then didn't stop falling to make lows year after year.

Why this difference between banks in Sweden and Italy, Germany or France?

Two reasons:

Because of the fixed exchange rate with Germany, many companies in southern Europe are going bankrupt, while the profitability of the Swedish business is protected by an exchange rate that fell during the crisis before rising again when the crisis was over. The exchange rate acts as a shock absorber and has fulfilled its role in Sweden, but not in the eurozone, which has been killed by German competition.

With interest rates at -1% and fixed costs at +2% (buildings, personnel etc..) the banks in the Eurozone cannot earn a profit, their costs being much higher than their profitability.

As companies in the Eurozone (ex-Germany) are no longer competitive, they stop making money and as banks can no longer lend given the interest rates (too low for the risks taken), growth collapses, tax revenues falls, spending increases and therefore public deficits explode higher and with them government debt.

Conclusion

Today, the Eurozone is facing a deep energy crisis that started with the Russo-Ukraine war prompting the EU states to start buying natural gas in dollars from the likes of Qatar.

But because of this rise in energy prices, the trade balance of the Eurozone, including Germany, is becoming negative, which means that in order to hold the exchange rate of the Euro, the EU will have to raise interest rates a bit more than necessary and thus make the coming recession even harder for Southern European states with Italy at the forefront.

The Eurozone has predictably created a huge contradiction between what Germany needs in terms of interest rates and what Southern Europe needs and we are only in the early innings of what might very well become another Eurozone crisis.

Good write up. You should also consider how there is no longer a strict consumption limit within the Eurozone due to the lack of an exchange rate. Therefore no hard budget restricition applies anymore to EMU member state - TARGET 2 balances being the thermometer of how bad allocation works.

So not only does inflation differencials lead to real wage asymetries but also no counter mechanism besides consumption repression remains an available policy tool to safeguard competitiveness.

Very good said!The whole Euro project is a

failure from the beginning.