Short Report: HelloFresh (ETR: HF)

Investment Thesis:

· HelloFresh is facing a more challenging outlook than consensus estimates as economies reopen

· Customer churn remains a major operational hurdle as “costless” customer acquisition driven by lockdown measures subsides as economies reopen

· Lower retention and lack of adoption of meal-kits by new consumers squeeze and lower margins driven largely by inability to control marketing costs

I. Company Overview:

1) Description:

HelloFresh delivers meal kit solutions to prepare home-cooked meals using its recipes. The company offers premium meals, double portions, and others, as well as add-ons, such as soups, snacks, fruit boxes, desserts, ready-made meals, and seasonal boxes. It also sells meal-kits through vending machines.

HelloFresh operates on a subscriber-based model. Meal prices range start from $8.75 per meal for a family plan which offers child friendly options along with food that is good to cater to two adults and two children. Customers are able to opt for a flexible subscription that allows them to receive a box of fresh ingredients and recipes every week.

The company has operations in the United States, Australia, Austria, Belgium, Canada, Germany, France, Luxembourg, the Netherlands, New Zealand, Switzerland, Sweden, Denmark, and the United Kingdom.

It operates under the HelloFresh brand. The company was founded in 2011 and is headquartered in Berlin, Germany.

2) Management:

Chief Executive Officer: Dominik Richter has been CEO since starting HelloFresh alongside Thomas Griesel in 2011. Dominik graduated from WHU with a degree in International Business in 2009, and from the London School of Economics in 2010 with a master’s in finance and worked for Goldman Sachs before founding HelloFresh.

Chief Financial Officer: Christian Gartner serves as Chief Financial Officer, Member of the Management Board of the Company. Prior to joining HelloFresh, Christian spent 19 years in banking, most recently at Bank of America Merrill Lynch where he ran the Equity Capital Markets business for the German speaking region

Chief Operating Officer: Thomas Griesel co-founded HelloFresh with Dominik Richter in 2011. Presently, he is Chief Operating Officer & CEO-International at HelloFresh. Thomas Griesel received an undergraduate degree from WHU-Otto Beisheim School of Management and a graduate degree from London Business School.

3) Key Shareholders:

Source: Company 10-K

4) Segments:

The company segments its business geographically as follows:

Given its leadership position in the market globally (60% of market in the US), HelloFresh has been one of the main beneficiaries from the Covid-19 crisis in the space as restaurants were closing down and lockdown measures put in place across the globe.

HelloFresh registered its first profitable quarter in 2019 and was well on its way to a solid 2020 but there’s little doubt that the pandemic has boosted its business beyond the most bullish expectations.

II. Industry Overview:

1) History of the Meal Kits Industry:

Meal kits are a type of meal delivery service, often subscription-based. They typically include fresh ingredients, sometimes pre-chopped and/or with premade sauces and spice blends, along with recipes to prepare home-cooked meals.

Meal kits originated in Sweden in 2007 with the launch of Middagsfrid. Middagsfrid quickly gained popularity for their convenience and spread to other European countries.

Meal kits entered the U.S. market a few years later with the launch of Blue Apron, Hello Fresh, and Plated (no longer in business online) around 2012. Shortly after, Home Chef launched. These days, there are more than 150 meal kit companies in the U.S. and hundreds more worldwide.

Most subscription-based meal kit companies find that there is high customer churn; customers tend to cancel within a few months to try another meal kit or to take a break as they don’t want to be locked into a subscription. The packaging that’s used to securely ship meal kits also has been criticized for contributing to landfill and environmental waste

2) Main Competitors:

Blue Apron, HelloFresh, Marley Spoon and Kroger (Home Chef) are some of the key players operating in the global meal kit market.

Blue Apron (NYSE:APRN – Market Cap: $112.9m ) : Founed in 2017, Blue Apron Inc. is an American ingredient-and-recipe meal kit service which exclusively operates in the United States. Due to high customer churn and overspending on marketing the company has seen its share price dive before the Covid-19 pandemic helped the company stay afloat and register double digit growth in earnings

Marley Spoon (ASX:MMM – Market Cap: $673.3m): Founded in 2014, Marley Spoon is a subscription-based weekly meal kit service that services customers in three primary regions: Australian, United States and Europe (servicing Austria, Belgium, Germany and the Netherlands)

Home Chef: Founded in 2013, Home Chef is an Ilinois-based meal kit and food delivery company that delivers pre-portioned ingredients and recipes to subscribers weekly in the United States. The company was acquired by Kroger in 2018 for $200 million with an additional $500 million in incentives. The company is estimated to have c.20% of the meal kit delivery market in the US.

Competition represents a major risk to HelloFresh particularly given the low barriers to entry that would prompt a new entrant to reassess the cost basis of a meal kit lower and succeed in taking market share at the expense of very low margins.

3) Industry Outlook

a) Total Adressable Market:

While HelloFresh estimates the TAM of the Food Market to be around $3.3Tr (see below). I don’t believe that the company’s TAM even at its peak will get close to $330Bn (10% penetration, Exane BNP Paribas estimates a penetration of 0.2% at $6Bn) because reaching that number would mean a complete change in consumption habits has occurred in addition to having grocery stores (Kroger being a good example) begin to cannibalize their market share in the grocery shopping segment and focus on meal kit delivery.

b) Barriers to entry:

· Customer churn: while being the number one operational challenge for HelloFresh and other players in the space, deters new entrants into the space.

· CaC and marketing: HelloFresh needs constant fresh blood to counteract churn and boost growth. To stay afloat, HelloFresh focuses up to one third of its revenue on marketing and has spent large amounts on influencer marketing, hiring thousands of influencers across different platforms.

· Low customer switching costs: customers can easily switch between competitors depending on the reduced prices or promotions each one of them offers which reduces stickiness and increase customer acquisition costs

III. What the market in getting wrong about HelloFresh:

1) Churn, CaC and growth sustainability:

There is no denying that the meal kit space has been supercharged during the pandemic and this unprecedented growth and interest from customers has allowed for increased margins spanning all players in the sector even those who, before, were in precarious financial positions such as Blue Apron.

2020 has been a year where the sector benefited from new customers because of lockdown measures and closed restaurants without the acquisition costs that usually come with it.

In a post pandemic world where the economies are open again, the key drivers for HelloFresh can be summed up a follows:

a) The frequency of orders of customers who remain in the platform:

As economies get closer to reopening, I believe that customers who have long adopted HelloFresh in the beginning of the pandemic and stuck with it throughout will keep ordering as improvements in the offer over the course of last year and diversified menus will entice them to keep ordering.

b) The churn rate directly attributed to the reopening of the economy and how to sustain revenue growth:

HelloFresh (and the sector as a whole) will have a very hard task ahead. Not only does the company need to reduce churn without the “help” of lockdown measures which allowed for almost costless customer acquisition, it will also need to increase the number of net new customers (active revenue generating customers minus inactive or departed ones from the platform) or/and value of orders to sustain its growth.

While the company is very protective of its churn numbers, an independent study(1) found that customer typically stick around for five months on average and yearly customer retention rates fluctuate between 10% and 15%.

b) Margins:

For a business model with a high churn rate, discussing margins in highly correlated with sales and scale.

Looking back at margins in both 2019 and 2020, it is clear that margins were boosted by the pandemic.

HelloFresh’s EBITDA margin increased from 9% in Q1 2020 to 15.8% in Q2 2020 only to go back down to 11.8% in Q3 2020 as discussion about vaccines intensified which in turn prompted talks about economies’ reopening and thus loss of business for meal kit delivery players.

i) United States

In the US, I believe Q1 2021 will still hold some benefits of the pandemic but that edge will slowly subside as vaccines are rolled out for the every age group and restaurants reopen fully. I expected EBITDA margins to be around pre-pandemic levels of around 9%

ii) Europe

This storyline will be completely different in Europe, where a third wave of Covid prompted governments to go into tight security measures to control the spread of the virus. The situation will still be favorable to HelloFresh’s margins and business overall.

iii) Australia & New Zealand:

Monitoring business performance in Australia and New Zealand, two countries where life is coming back to pre-pandemic ways, could provide a glimpse of what we might expect to happen in the US in Q2 and Q3 2021 and Europe later this year.

During the Q4 earning call, management has already acknowledged a slowdown in Q4 both in terms of average order value and volume of orders.

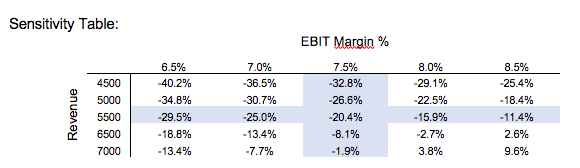

IV. Valuation

V. Risks to the thesis

· Momentum has been better than expected and this could continue.

· I modeled and valued the shares in line with management's current double digit EBITDA margin range but it is possible they raise this or clarify it more precisely.

· The COVID-19 crisis could further accelerate demand with for instance, customers proving more loyal or being cheaper to acquire.

References:

(1) https://www.linkedin.com/pulse/meal-delivery-here-stay-only-healthy-side-good-unit-daniel-mccarthy/

(2) https://www.extole.com/blog/how-blitzkrieg-marketing-turned-hellofresh-into-the-leading-d2c-mealkit-company/