TMT Series #5: Universal Music Group (UMG) and the Music-as-a-Service paradigm (Part 1/2)

Since the advent of Spotify in 2006, music streaming has increasingly taken center stage and enabled listeners to carry their favorite music catalog and listen to it many times over for a monthly subscription. In today’s series, we take a deeper look at how streaming changed the music industry’s business model for the better, how UMG enables this change and why the company is cheaply valued given future prospects of both revenue growth and margin improvement.

Sections

I. Brief Primer on the music industry

II. History of the music industry from the late 90's to today

III. UMG business overview

IV. Key revenue drivers for UMG looking ahead

V. Valuation

VI. Conclusion

Before we delve into what makes UMG a great investment or even the whole industry an attractive one. I thought it might be useful to briefly go over the music business’ different segments and understand how they are intertwined with one another.

I. Brief Primer on the music industry

A. Recorded Music

Recorded music is about discovering artists, giving them an upfront to fund the development of their work and working with them to create the best music and marketing that work to the world. The investment and scouting of talents is what is called A&R or Artist & Repertoire and can be considered as the R&D of the music industry.

This segment is akin to the venture capital business, the idea for UMG and its competitors is to invest early into an artist’s career and share their success later on by locking in rights to future recordings (exclusivity is at 95 years in the U.S and 70 years in Europe) . Unfortunately, most artists are not successful and those that are compensate for the sunken costs initiated by UMG on the loss making artists.

B. Publishing

Publishing represent songwriters or lyricists, publishers will license, promote and monetize rights to musical compositions and lyrics. In exchange, music publishers share royalties with songwriters. These royalties are subject to government minimums (The copyright Royalty Board in the US) and last for 70 years after the author’s death.

Royalties are reported by listening format:

· Performance: includes radio, streaming, public performances (concerts, night clubs) and are collected by the Performing Rights Organizations (PROs)

· Digital: Various digital formats and performances of musical compositions to the general public including streaming and download services

· Synchronization (“ Sync”): Licensing income associated with “time synchronization" of music against visual images (e.g., a movie, TV show or commercial)

· Mechanical: paid whenever a musical composition is copied, distributed or re transmitted including CDs, Vinyl, DVDs, etc.

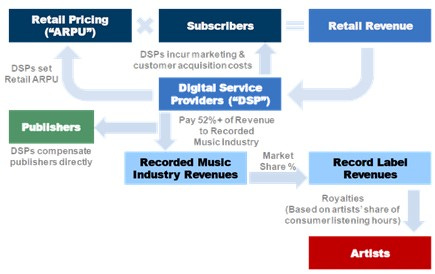

The above snapshot explains how the paid streaming ecosystem works. The DSPs are central to the model , they are the ones going around trying to acquire the end users (you and I, the subscribers) and thus bear the costs associated with marketing their platform.

The DSPs also set the ARPUs (average revenue per user) or subscription cost which vary greatly between different regions of the world. The price variation depends on the state of the market and the purchasing power of the potential subscribers. If Spotify wants to open a new market in an African country for example, it wants to change the consumers’ habits and need to set a compelling subscription price which will be way lower than what American/European Spotify subscribers pay for their subscription.

1- Retail revenue is a DSP topline from which the major chunk goes to recorded music players who then split those revenues with the individual artists based on consumer listening hours

2- Publishers are also paid directly by DSPs

A company such as UMG houses both publisher and recorded music services for songwriters and performers as we will see later on in this deep dive which provides great pricing pressure on DSPs

I. History of the music industry from the late 90’s to today

A. How did streaming transform the industry

Going into 1999, the music industry was geared towards growth with a 8% CAGR of revenues between 1990 and 1999. With the emergence of technology such as Napster and piracy, revenues quickly dwindled and many forecasted the death of the industry. As iTunes started to get some steam after its release in 2001, technology shifted from being the enemy to being the friend of the industry through a one-time download model which Spotify changed to streaming and thus helped revive the industry.

Today, there are 400+ streaming services with the largest being Spotify, Amazon Music, Tencent Music and Apple Music among others.

(Source: RIAA)

What is interesting about music is that it has followed a very similar trajectory as the software industry. In the early innings, you had a physical box of Microsoft Windows, then you had software which you could download of the internet and then the SaaS model we know today. I like to think of UMG as a MaaS company as in Music-as-a-Service.