Which equity sectors can combat higher inflation?

Many investors today are worried about inflation in the wake of the FED's slow tapering speed. Let' s look at which equity sectors could prove to be the most resilient

The sharp rise in bond yields over recent weeks has rattled equity markets amid fears that fiscal stimulus and a post-pandemic spending splurge could stoke hyperinflation. Five-year inflation expectations, as measured by the yield difference between nominal and inflation-protected US Treasury bonds, have rebounded sharply from their pandemic lows and are now at their highest level since 2008.

Moderate inflation is generally good for equities because it tends to be associated with positive economic growth, rising profits, and stock price gains. However, things can quickly turn ugly for stock-market investors if the economy overheats and inflation rises too high.

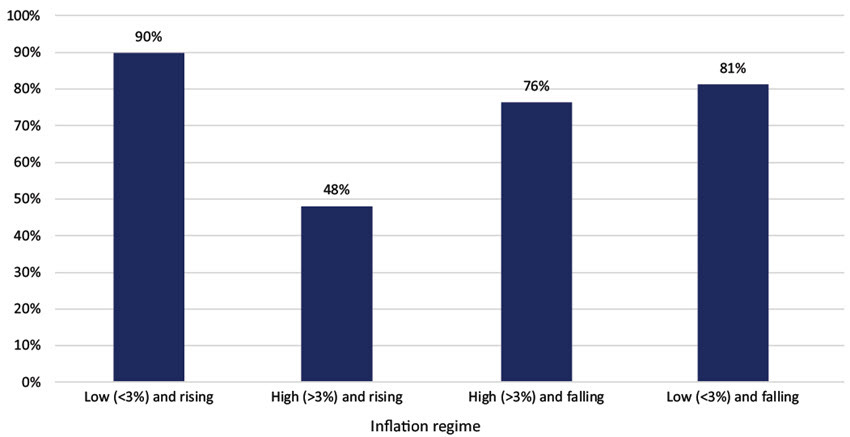

Historically, equities outperformed inflation 90% of the time when inflation has been low (below 3% on average) and rising—this is where we were a couple of months ago as the FED was pushing its “inflation is transitory narrative”

But in a higher inflation environment (above 3% on average), equities fared no better than a coin toss, as shown in the chart below.

% of Rolling 12-Month Periods When US Equity Returns Exceeded Inflation Rate, 1973-2020

(source: Datastream & Refinitiv)

Fortunately, not all sectors are equally affected and some may prove more resilient than others if inflation takes off.

What Is the Relationship Between Equity Prices and Inflation?

In theory, equities should offer a buffer against inflation because a rise in prices should correspond to a rise in nominal revenues and therefore boost share prices. On the other hand, this may be offset by a contraction in profit margins given an increase in companies’ input costs.

In practice, the impact of inflation on earnings will vary by economic sector and its ability to pass on higher input costs to consumers. But as long as input costs do not increase at the same rate as revenues, the rise in profit margins could translate into greater nominal earnings.

The problem is that the market will often discount those future cash flows at a higher interest rate when inflation rises to compensate for the fact they are worth less in today’s money. All else being equal, the higher the level of inflation, the greater the discount rate applied to earnings and, therefore, the lower the price-to-earnings (P/E) ratio investors are prepared to pay.

High Inflation Tends to Hurt P/E Multiples

(source: Refinitiv)

Which Equity Sectors May Offer Shelter Against Rising Inflation?

A potential inflation hedge is an investment that can mitigate the impact of price increases. So how often do different equity sectors achieve this and how well does it work?

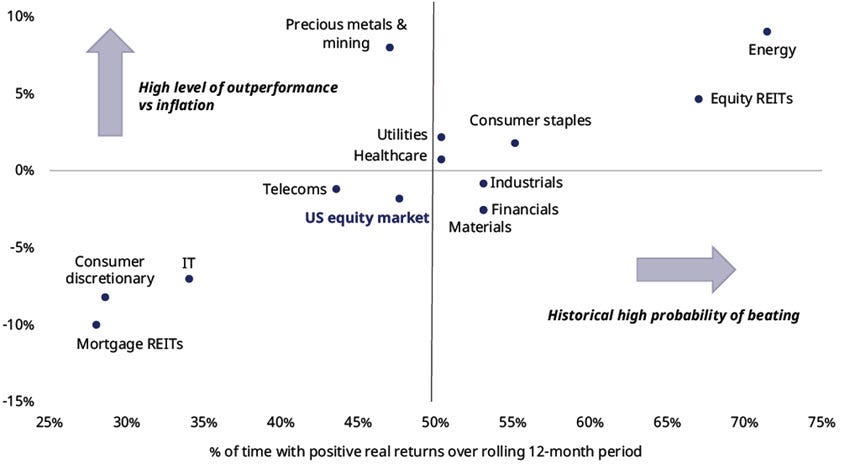

In the figure below, the x-axis shows the percentage of rolling 12-month periods since 1973 in which equity returns exceeded inflation in high and rising inflation environments—a measure of how consistently each sector has beaten inflation in these environments.

The y-axis shows the real (inflation-adjusted) return achieved during those periods—a measure of how much they have beaten inflation by, on average, in these environments.

US Equity Sector Performance in High (+3% on Average) and Rising Inflation Environments, 1973-2020Average 12-month inflation-adjusted return, %

(source: Refinitiv)

Although equities in general have performed quite poorly in high and rising inflation environments, there are potential areas that have historically performed better at the sector level. The energy sector, which includes oil and gas companies, is one of them. Such firms beat inflation 71% of the time and delivered an annual real return of 9.0% per year on average.

This is a fairly intuitive result. The revenues of energy stocks are naturally tied to energy prices, a key component of inflation indices. So by definition generally have performed well when inflation rises.

Equity REITs (real estate investment trusts) may also help mitigate the impact of rising inflation. They outperformed inflation 67% of the time and posted an average real return of 4.7%. This makes sense too. Equity REITs own real-estate assets and may provide a partial inflation hedge via the pass-through of price increases in rental contracts and property prices.

In contrast, mortgage REITs, which invest in mortgages, are among the worst-performing sectors. Just like bonds, their coupon payments generally become less valuable as inflation increases, sending their yields higher and prices lower to compensate.

The same is true of promised future growth in profits for IT/Software/Technolgy stocks. The bulk of their cash flows are expected to arrive in the distant future, which may be worth far less in today’s money when inflation increases. Financials, on the other hand, have performed comparatively better, as their cash flows tend to be concentrated in the shorter term.

But high inflation can still be especially harmful for banks because it erodes the present value of existing loans that will be paid back in the future.

Utility stocks display a somewhat disappointing success rate of 50%. As natural monopolies, they should able to pass on cost increases to consumers to maintain profit margins. However, in practice, regulation often prevents them from fully doing so.

What’s more, given the stable nature of their business and dividend payments, utility stocks are often traded as “bond proxies,” meaning they might be bid down relative to other sectors when inflation takes off (and bond prices fall).

Meanwhile, although gold is often touted as a hedge against currency debasement fears, the track record for companies in the precious metals and mining sector is mixed.

In summary, if inflation keeps going up, equity prices could/will react unfavorably, but some sectors may absorb the impact better and others are even poised to benefit.